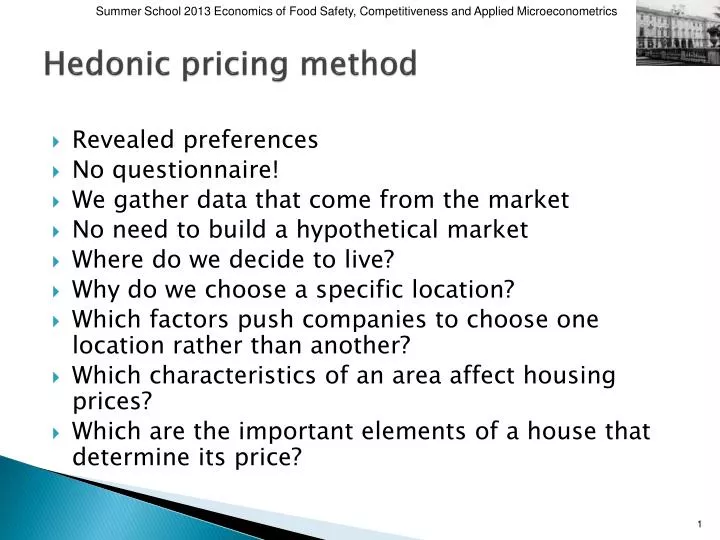

There are two parts to performing hedonic regression analysis. The hedonic pricing model is common in the housing sector because of its flexibility and ability to accommodate various factors and parameters in the determination of a fair property price.The method is commonly applied in the valuation of properties, such as houses, and accounts for economic costs or benefits, which may influence the overall value of the asset or, as commonly presumed, a house.Hedonic pricing – or the hedonic pricing method – is used in the determination of the economic value for an ecosystem service or services that may influence the market price of a good or asset.Global Decision is currently analyzing several datasets to determine what, if any, impact preference shifts might produce over the long-term. However, for long-term trending, a significant shift in how consumers value a property will cause a distortion in the model. Over the short-term, consumer preferences and market valuation do not change much. The specific valuation of an element (such as a bathroom) should add about the same $$ or % to the worth of a property over time. For example, if the a home sale record lists 3 beds, 2 baths, a 2 car garage, and a total size of 0 sq ft, that record is erroneous that can not be used in the regression model.įinally, one subtle issue with hedonic regression models is that they assume that the way a market values the components of a property does not change over time.

Second, they can't handle data points where even one element is missing or dirty. First, they require a considerable amount of data for each time period, neighborhood, or other factor under consideration. Hedonic indexes suffer from a few common issues. With that said, they are not perfect (no method is). We think hedonic real estate indexes are a solid way to measure price movements over time. What are the weaknesses of hedonic indexes? As a simple illustration of this, consider the following chart, based on the above example. The price = c1 + sqft * c2 structure of the equation creates a situation where PPSF naturally declines as size increases. Even the most basic linear regression model is less distorted than both a simple median and a price-per-square-foot (PPSF) approach. a linear model is not a correct approximation at the endpoints), but we can ignore that fact for the time being.īecause the regression analysis develops a relationship between the salesprice, the square footage, and the time of sale, trends over time are less subject to distortion. In practice, such relationships tend to break down (i.e. Even if a home has zero square footage of size, it's still theoretically worth $160,000. Third, homes have an "intercept" of $160,000. Second, each square foot of home adds $100 in value. In our situation, this means that prices have not changed from month to month. R reports a few facts from the above output. Using notation from the excellent open-source statistics package R, our model would be represented as follows: In reality, the underlying value of any given home has remained unchanged.Ī hedonic approach would run a regression model to fit a relationship between the sales price of a home, the sqft of the home, other factors in the model (omitted for this example), and the time period of the homeís sale. Using the above data, we will find that the median home value increases month-over-month and the median price per square foot decreases month-over-month. Small homes have constant value at $320,000 and large homes have constant value at $360,000. Consider town with only two types of properties: small (1600 sqft) homes and larger (2000 sqft) homes. A simple example will illustrate why this is the case. With enough data points, over enough time, a regression model can be used to determine the relationship between each of these parameters and the value of a home.īecause a hedonic approach is based on a holistic view of all the data available, it is not inherently skewed by the mix shifting to larger (or smaller) properties. A home can be viewed, mathematically speaking, as a collection of parameters such as (beds=3, baths=2, garages=2, sqft=1800, lotsize=2500, neighborhood=Woodbridge, Irvine, CA, and so forth). The term "hedonic" refers to the concept that the value of a home can be determined by looking at the value of the constituent components of a home. A hedonic price index is a fundamentally different method for calculating home price trends.

0 kommentar(er)

0 kommentar(er)